Previous installments of this series looked at the consequences of late-stage (Part 5) and mid-stage (Part 6) global export mitigation.

In this article, I consider early-stage global mitigation.

In the late- and mid-stage global export mitigation strategies, I assumed that the various regions would continue their existing export trends until the per capita consumption for each particular regions in my study reached a per capita consumption rate of 1 or 2 barrels of petroleum per person per year (b/py). At that point, the particular region under consideration was assumed to cut their exports by an amount sufficient to keep the region at the assumed per capita consumption rate (i.e., 1 or 2 b/py) for as long as possible, until their exports drop to zero. At that point, the region’s petroleum consumption is defined by it’s domestic production plus whatever imports it may still get from the other regions.

In the present analysis I have assumed that, starting in 2012 (the first prediction year in my PIE analysis), all exports between regions cease, and, each region must live within its own means. That is, each region’s domestic production of petroleum corresponds to the amount of petroleum available for consumption.

There are a few reasons why I don’t see this as a very realistic scenario.

First, I don’t think that the net exporting regions could tolerate the economic hardships associated with cutting their exports to zero. Many of the countries in the Middle East, former Soviet Union, Africa, and South America are highly dependent on income from exporting petroleum to the net importing regions. Cutting all exports would be economically devastating to these countries. Second, I don’t think that the net importing regions would tolerate the economic hardships, and likely starvation in some cases, associated with having their imports cut to zero. As you will see, regions like Japan and the remaining Asia Pacific regions would immediately be in trouble, with their per capita consumption rates dropping below the level needed to sustain the petroleum-driven food production system.

It is unlikely that under this scenario’s assumed rapid drop in petroleum imports, the countries in these regions facing economic collapse and starvation would passively sit by while other net exporting regions enjoy their own relative booming petroleum resources.

No, they would likely come in and take by force, I think.

So, why spend time looking at an early-stage export mitigation strategy at all?

There are a few benefits. First, working through an early-stage export mitigation strategy illustrates better than any of the other strategies, I think, which regions are most vulnerable to a sudden loss in petroleum exports. Second, the early-stage mitigation strategy illustrates the best possible outcome that the net exporting regions might expect to achieve to delay starvation and population decline.

Third,

the early-stage mitigation strategy is an extension of the late- and mid-stage mitigation scenarios already explored and, as such, shows the full-range of economic and population shifts that may be possible. With the completion of an early-stage analysis, I will have looked at the production and export trends scenarios ranging from no mitigation to full-on mitigation, with two intermediate mitigation scenarios (late- and mid-stage) in between.

Analysis Considerations

As indicated above, the premise of early-stage export mitigation is that starting in 2012 through to 2065, each region stops exporting altogether and consumes only its domestic petroleum resources. As assumed for all of my scenarios, when a region’s per capita petroleum consumption rate drops below the critical level of 1 b/py, the region’s population will start to decline proportionally, to keep per capita consumption at 1 b/py for the remaining population.

Although this sounds straight-forward enough, there are different ways that a region could decide how to utilize it’s remaining petroleum resources. For all of the regions except one (Japan), I considered two different early-stage mitigation strategies. If early-stage mitigation were to actually occur, perhaps the reality would be somewhere in-between these two strategies.

Early-stage mitigation strategy (1)

In strategy (1), I assume that a region decides, based upon their present petroleum production trend, how much petroleum they will be able to produce within the study period (i.e., the next 53 years from 2012-2065) and then control their domestic petroleum consumption so as to keep the per capita petroleum consumption rate as high and as constant as possible throughout the entire study period. Under this assumption the per capita petroleum consumption rate is not just a simple average of total estimated petroleum resources divided by 53 years. Because the population of each of these regions is changing throughout the study period, keeping per capita petroleum consumption constant means that one has to adjust the amount of yearly consumption up or down according to the population trend, still not run out by the end of the study period. For instance, if the population change is in a positive trend, then the amount of yearly petroleum consumption has to be increased just to keep the per capita consumption rate constant. If the population change is in a negative trend, then the amount of yearly petroleum consumption can decrease to keep the per capita consumption rate constant. Obviously the maximum steady per capita consumption rate for a region has to be decreased to accommodate an increase population trend, whereas the per capita consumption rate can be increased if there is a decreasing population trend.

Even within this strategy, I have to make another assumption to stay within the realm of the plausible for some of the regions (e.g., AF, rAP and EU).

I have further assumed that, if a region’s petroleum resources are so low that equal apportionment throughout the study period would put its per capita petroleum consumption rate below 1 b/py, then the strategy is modified to keep per capita petroleum consumption at 1 b/py for as long as possible. When domestic petroleum resources can no longer keep per capita consumption at least 1 b/py, then population decline is assumed to set in, with the lower limit assumed to equal to that region’s population in the year 1900.

Early-stage mitigation strategy (2)

In strategy (2), I assume that a region decides to just keep producing domestic petroleum according to it’s present trend. Consequently, the per capita consumption rate equals the projected domestic consumption rate divided by the projected population.

Once again, to be realistic, I have assumed that once the projected per capita consumption rate drops to 1 b/py then the population would start to decline at a rate that is supportable by the declining petroleum production until reaching a lower limit equal to that region’s population in 1900.

In the figures to follow, the early stage mitigation strategy (1) shows per capita consumption rate (“consumption” left axis) as solid pink lines and notations, with any resulting population reduction consequences (“population” right axis) show as solid indigo lines and notations.

The early stage mitigation strategy (2) shows per capita consumption as solid orange lines and notations, with any resulting population reduction consequences show as solid blue-grey lines and notations.

For comparison, I continue to show the per capita consumption rate and population scenarios based upon my original analysis assuming no mitigation (Part 1, Part 2 and Part 3), and upon the late-stage (Part 5) and mid-stage (Part 6) global mitigation analysis all shown as various dashed lines.

Assessing Early-Stage Global Export Mitigation Strategies

Middle East (ME)

Figure 45 shows the ME’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies considered.

Based on logistic equation modeling of ME’s production data (see Figure 1, Part 2), I estimated that from 2012 to 2065, ME would produce a total of 230 bbs of petroleum. Needless to say, the ME is flush with petroleum, and, if it only had to meet its own domestic per capita consumption rate needs at present levels, it could do so for at least the +5 decades of the study period.

Under my early-stage mitigation strategy (1), with accounting for ME’s population increase over the study period, the ME could consume at a steady per capita rate of 14.7 b/py (pink line) for the next 53 years. That is actually slightly higher than its rate of13.9 b/py in 2011. Moreover, this would only correspond to a petroleum production rate of about 3.2 bb/y in 2012, which is well below ME’s production rate of 9-10 bb/y in 2011.

In other words, ME could idle or slow its domestic production by about 70%, keeping the remaining petroleum in the ground, and still meet more than its present domestic per capita consumption rate. The production rate would have to increase to about 5 bb/y by 2065 to accommodate the increasing population, but, that would still be only about 50% of its present production rate.

There is one problem with this scenario, however. By the end of the study period, 2066, ME’s projected production rate is down to a level that, given the projected population of 342 million in 2066 (up from 215 million in 2011), the per capita consumption rate would only be 1.9 b/py (see * in Figure 45). That means that per capita consumption would have to drop from 14.7 b/py in 2065 to 1.9 b/py in 2066. Of course, one could contemplate milder and delayed transitions, by extending the study period out farther in time, by lower the assumed steady per capita consumption rate (e.g., about 7.35 b/py for 106 years, or 3.7 b/py for 206 years).

Alternatively, under my early-stage mitigation strategy (2), if the ME just kept up its present petroleum production rate, and used this all domestically, then per capita consumption would rocket up to 43.2 b/py in 2012. However, the combination of declining production rates and increasing population causes the per capita consumption rate to drop down to 2 b/py by the end of the study period in 2065.

Under either of these early-stage strategies, because the per capita consumption rate is well above my critical level of 1 b/py, ME’s population is predicted to follow to the trend predicted by the census bureau.

Former Soviet Union (FS)

Figure 46 shows the FS’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies considered.

Based on my logistic equation modeling of FS’s production data (see Figure 6, Part 3), I estimate that from 2012 to 2065, FS would produce a total of 67 bbs of petroleum. Similar to ME, if FS only had to meet its own domestic per capita consumption rate needs at about present levels, this amount would be sufficient for at least 5 decades.

Under my early-stage mitigation strategy (1), with consideration of FS’s population decline over the study period, FS could consume at a steady per capita rate of 4.75 b/py (pink line) for the next 53 years. This is just slightly less than its 2011 rate of 5.3 b/py. To provide this, the production rate would only need to be about 1.3 bb/y, which is well below FS’s 2011 production rate of 4.9 bb/y. Thus, similar to ME, FS could idle or slow its domestic production rate by about 73%, keeping the remaining petroleum in the ground, and meet more than its present domestic per capita consumption rate. Therefore unlike all of the other scenarios examined for FS in this series, FS could thereby avoid a population crash during the study period.

Like ME, however, problems occur past study period. By 2066, FS’s petroluem production rate is projected to be close to zero, and consequently, the per capita consumption rate would crash to about 0.04 b/py. And, accompanying this per capita consumption rate crash, there would be a rapid population crash down to the year 1900 population level.

Once again like ME, such a sharp transition could be reduced and delayed by extending the period out to farther times with lower study per capita consumption rates (e.g., roughly 2.4 b/py for 106 years, or 1.2 b/py for 206 years).

Alternatively, under my early-stage mitigation strategy (2), if FS kept up its present petroleum production rate, and used this all domestically, then per capita consumption could increase to 17.2 b/py in 2012. That would put FS’s per capita consumption at about the same level that North America was at in 2011. But, with FS’s projected steep decline in domestic production, this huge bounty of per capita petroleum consumption would be fairly short-lived. By 2029, per capita consumption is predicted to be back down to 5 b/py, and below 1 b/py by 2043, with a corresponding population crash back down to FS’s year 1900 level of 121 million by 2048. This is actually about the same as the population crash scenarios predicted under the late-stage and mid-stage mitigation strategies.

Africa (AF)

Figure 47 shows AF’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies being considered.

By now you know the drill: from modeling of AF’s production data (see Figure 12, Part 4), I estimate that from 2012 to 2065, AF would produce a total of 22 bbs of petroleum. Unlike ME and FS, however, this is not enough to meet AF’s projected domestic per capita consumption rate needs over the study period.

As you can see from Figure 47 AF’s per capita consumption rate was about 1.2 b/py. However under my early-stage mitigation strategy (1), even if we reduce the per capita consumption rate to 1 b/py, given AF’s projected increasing population, this minimum level of consumption can only be sustained until 2028. Thereafter, with the petroleum reserve exhausted, the per capita consumption rate crashes, and along with it, the population crashes. Under this scenario AF’s population would drop from 1.46 billion in 2028 to its year 1900 level population of 140 million in 2029.

This may not seem like much of a “strategy,” but there is one ostensible benefit over the mid-stage and late-stage mitigation strategies. Under those strategies, a per capita consumption rate of 1 b/py was only sustained until 2020-21; whereas here, that level can be sustained until 2028. But, the ensuing population crash back down to year 1900 levels is even steeper than under the mid-stage and late-stage mitigation strategies.

Early-stage mitigation strategy (2), doesn’t give much better outcome, in my view.

If AF continued its present petroleum production rate, and used this all domestically, then per capita consumption could increase to 2.9 b/py in 2012. But, the combination of increasing population and decrease production rates would cause the per capita consumption rate to drop below 1 b/py by 2019. The ensuing population decline is slightly more gradual than under strategy (1), but, still reaches the year 1900 level population by 2031.

South America (SA)

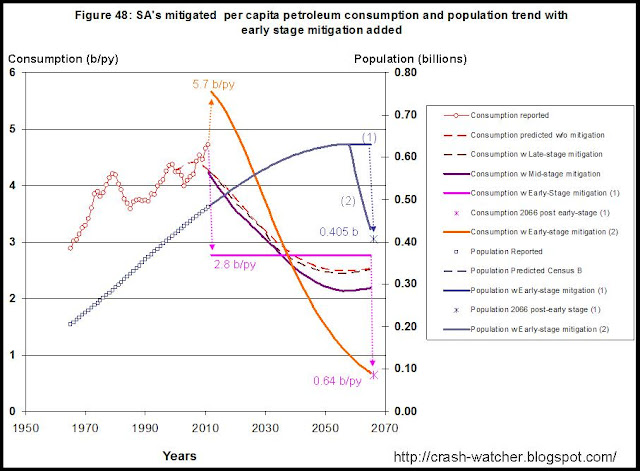

Figure 48 shows SA’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies being considered.

Modeling of SA’s production data (see Figure 17, Part 5), suggests that from 2012 to 2065, SA could produce a total of 87 bbs of petroleum—quite a bit more than either of FS or AF, even though these regions are presently larger net exporters than SA. At least under one early-stage mitigation strategy this is sufficient to keep SA’s per capita consumption rate above the 1 b/py critical level.

Under early-stage mitigation strategy (1), SA’s per capita consumption rate can be as high as 2.76 b/py and still get through the study period. The needed petroleum production rate to attain this per capita rate is about 1.35 bb/y which is about half of SA’s production rate in 2011. So, SA’s domestic production rates could be reduced by 50% and still provide the steady per capita rate of 2.76 b/py.

However, like ME and FS, there is a bad surprise at the end of the study period. After the study period in 2066 the per capita consumption would be down to 0.64 b/py, which, in turn, would cause a population crash from about 600 to 406 million.

Under early-stage mitigation strategy (2), if SA continued its present petroleum production rate, and used this all domestically, then per capita consumption could increase to 5.7 b/py in 2012.

SA’s increasing population until about 2060 and decreasing production rates causes the per capita consumption rate to drop below 1 b/py by 2058 with a population decline to 429 million by the end of the study period in 2065.

North America (NA)

Figure 49 shows NA’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies being considered.

Modeling of NA’s production data (see Figure 24, Part 6), suggests that from 2012 to 2065, NA could produce a total of 266 bbs of petroleum—even more than ME’s estimated total production over this period. NA’s per capita consumption rate under either strategy (1) or (2) remains well above the critical level of 1 b/py, and therefore, the region’s population is expected to follow the trend predicted by the census bureau.

Although the domestic production rates in NA can’t meet present domestic consumption needs, domestic production could still provide a reasonable per capita consumption rate, by global standards anyways.

I will expand on this point at little bit before turning to the early-stage strategies. In 2011, NA’s domestic production rate was about 5.4 bb/y, but, its domestic consumption rate was about 8.4 bb/y, and its per capita consumption rate was about 18.3 b/py. Even if domestic production could be somehow increased to 8.4 bb/y, or higher, since NA’s population is increasing, those estimated reserves of 266 bbs would only last till about 2038 at a per capita rate of 18.3 b/py. At that point, the reserves are all gone, and therefore per capita consumption would go to 0, with a corresponding rapid population crash from 581 million in 2038 to NA’s 1900 level population of 82 million. Not really a good way to proceed, in my opinion.

Under early-stage mitigation strategy (1), NA’s per capita consumption rate could be 8.5 b/py to get through the study period. That’s only slightly below Europe’s per capita consumption rate of 8.9 b/py. The needed petroleum production rate to attain this for 2012 would be about 4 bb/y which is about 26% less than NA’s production rate of 5.4 bb/y in 2011.

So, reducing domestic production rates by 26% in 2012 to 4 bb/y and then slowly increasing it as the population increases could provide a steady per capita consumption rate of 8.5 b/py. For instance, by 2065, production would have to be 5.8 bb/y in order to keep providing 8.5 b/py to the then projected population of 684 million.

Unfortunately, at the end of the study period, we still get the same kind of bad surprise as we saw for ME, FS and SA, but not as bad.

By 2066, NA’s production is predicted to by about 4.5 bb/y which would only provide a per capita consumption rate of 6.5 b/py (* in the figure) for the still growing population of 688 million. While there is a short-fall from the steady level of 8.5 b/py, this is nowhere near the post-study period drops projected for ME (1.9 b/py) FS (0.04 b/py) or SA (0.64 b/py).

Still, dropping from 2011 per capita consumption levels of 18.3 b/py to a +50 year sustainable level of 8.5 b/py, would likely cause a severe immediate economic crash and therefore I do not see this as a strategy that would be voluntarily adopted.

Under early-stage mitigation strategy (2), if NA continued its present petroleum production rate, and used this all domestically, then per capita consumption would be 11.2 b/py in 2012. This is a little better than 8.5 b/py under strategy (1), but, would probably still cause too much of an immediate economic shock to be a desirable strategy.

NA’s continued increasing population throughout the study period (peaking well beyond 2100, based on my extrapolation of the census bureau’s prediction out to 2050) and slow declining domestic production cuts into the per capita consumption rate under this strategy. For instance, by 2065 per capita consumption is down to 6.6 b/py. Still, this is higher than any of the other regions under an analogous early stage mitigation strategy (2).

European Region (EU)

Figure 50 shows EU’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies considered.

Modeling of EU’s production data (see Figure 29, Part 7), suggests that from 2012 to 2065, EU would produce a total of 11 bbs of petroleum. Even if it could produce this all at once (e.g., by the unlikely act of increasing production to about 3.5 times higher than the 2011 rate of 1.5 bb/y) this would only cover EU’s 2011 consumption rate of 5.4 bb/y for a few years.

As you can see early-stage export mitigation has rapid negative consequences for EU.

Under early-stage mitigation strategy (1), by reducing its petroleum production rate to about 0.6 bb/y EU’s per capita consumption rate could be maintained at the critical level of 1 b/py until 2029. This would be a huge 90 percent drop compared to EU’s per capita consumption rate of 8.9 b/py in 2011 with devastating economic consequences. Thereafter, in 2030, with the oil reserve exhausted, the population would crash from about 600 million to the year 1900 level of 400 million.

Under early-stage mitigation strategy (2), if EU continued its present petroleum production rate, and used this all domestically, then the per capita consumption rate could be about 2.1 b/py in 2012. Of course the economic consequence would still be huge given this 80 percent drop in per capita consumption. The predicted declining trend in petroleum production causes the per capita consumption to drop below the critical level of 1 b/py in 2019, and a few years later in 2022, the population has dropped to the year 1900 level of 400 million.

Japan (JP)

Figure 51 shows JP’s per capita petroleum consumption and population trends with the global early-stage petroleum export mitigation being considered.

Early-stage export mitigation has an even worse effect on JP than it does on EU.

As I discussed in Part 8 of my previous series, most of JP’s small rate of petroleum “production” comes from “refining gains,” associated with the importation and refining of crude oil into usable products for domestic use and some exports. The EIA estimated JP’s actual domestic production of petroleum in 2011 to about 5000 barrels per day, or, 0.0018 bb/y. This gives a per capita consumption rate of about 0.014 b/py, which is well below the critical level of 1 b/py and a small fraction of JP’s per capita consumption rate of 12.8 b/py in 2011.

In this context it doesn’t make much sense to talk about mitigation strategies (1) and (2): under a scenario where all regions stop exporting altogether, JP’s refining gains would vanish and after rapidly blowing through its meager strategic reserves of 0.044 bbs, its per capita consumption would crash to about 0.014 b/py. Consequently JP’s population would crash to its year 1900 level of 44 million.

The remaining Asia-Pacific region (rAP)

Figure 52 shows rAP’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies being considered.

Modeling of rAP’s production data (see Figure 44, Part 10), suggests that from 2012 to 2065, rAP would produce a total of 30 bbs of petroleum. That’s about 3 times more than EU’s projected reserves, or, 1.5 times more than AF’s projected reserves. However, rAP’s present population of 2.4 billion (growing to 3 billion by 2034), pretty well renders this domestic petroleum reserve inadequate for the study period under early-stage export mitigation strategies.

Under early-stage mitigation strategy (1), rAP would have to substantially increase its domestic production rate to 2.4 bb/y, from 2011 rates of 1.4 bb/y, just to get up to the critical per capita consumption rate level of 1 b/py. I have strong doubts that this would be possible, but, even if we assume that it is possible, then rAP could maintain a per capita consumption rate of 1 b/py only until 2023. After that, the reserves are exhausted, and the population crashes to the year 1900 level of 464 million.

Under early-stage mitigation strategy (2), if rAP continued its present petroleum production rate, and used this all domestically, then the per capita consumption rate would be 0.57 b/py in 2012. This is already below the critical level of 1 b/py and, therefore under this strategy, I predict that the population would immediately collapse to 0.57 times the 2012 population estimated by the census bureau—a drop from 2011 levels of 2.4 billion to 1.37 billion.

If you understand this analysis, you will recognize that to have 1 b/py for a population of 1.37 billion, then rAP’s production rate in 2012 must equal 1.37 bb/y, which of course, is what the projected petroleum rate equals from Figure 44, Part 10. And, in 2039, when the production rate is projected to drop below 0.46 bb/y, rAP is back down to it’s year 1900 population limit of 464 million. (Hey, after a while, you can start to do these calculations in your head.)

China (CH)

Figure 53 shows CH’s per capita petroleum consumption and population trends with the two global early-stage petroleum export mitigation strategies considered.

Modeling of CH’s production data (see Figure 39, Part 9), suggests that from 2012 to 2065, CH would produce a total of 111 bbs of petroleum—more than projected reserves for AF and SA combined, although CH’s present population of 1.3 billion is slight less than the population of these two regions combined (1.5 billion in 2011). As I have pointed out in previous posts, CH’s population is projected to peak in the mid 2020s at just under1.4 billion. The declining population thereafter, plus CH’s projected increasing petroleum production rate, puts CH in a better position to tolerate early-stage export mitigation than other net-importer regions like EU, JP or rAP, or even some net-exporter regions like AF or SA.

Under early-stage mitigation strategy (1), CH’s per capita consumption rate can be 1.55 b/py and still get through the study period. The needed petroleum production rate to attain this is about 2.1 bb/y which is about 60 percent lower than CH’s production rate in 2011 (3.5 bb/y). That is, CH’s domestic production rates could be reduced by 40% and still attain the per capita rate of 1.55b/py through the study period. However, 1.55 b/py would also correspond to a substantial 42% drop in per capita consumption as compared to 2011 levels (2.66 b/py) suggesting a severe economic decline.

Unlike ME, FS, SA, or even NA, however, there is no bad surprise at the end of the study period. Because the population is in decline and production is projected to steadily increase, by 2066 CH’s per capita consumption rate is predicted to equal 2.1 b/py which is higher than the steady per capita consumption rate of 1.55 b/py.

Under early-stage mitigation strategy (2), if CH continued its present petroleum production rate, and used this all domestically, then per capita consumption would drop down to 1.1 b/py in 2012. Thereafter, however, per capita consumption is predicted to rise to 2 b/py by the end of the study period in 2065.

Because CH’s per capita petroleum consumption rate never drops below 1 b/py under either strategies (1) or (2), I expect the population to follow the trend predicted by the census bureau.

Summary and Conclusions

Early-stage export mitigation strategy (1) benefits the net-exporters like ME, FS and SA who could stay near, or in some cases, above present per capita consumption levels and thereby maintain their population trend at least to the end of the study period in 2065. But, after wards, in 2066 all three regions would suffer substantial declines in per capita consumption due to declining production rates. For FS the decline would be severe enough to cause a population crash at the end of the study period.

Early-stage export mitigation strategy (2) changes the outcome for these regions in that after an initial upwards spike in per capita consumption rate compared to present levels, the per capita rate goes into a steady decline thereafter. This causes FS to undergo a population crash much earlier in 2043 and even SA has a population decline starting in 2058.

Early-stage export mitigation strategy (1) allows AF to delay its population crash by 7-8 years as compared to the mid- and late-stage mitigation strategies discussed in early parts of this series. But then, the population crash is rapid and complete back down to year 1900 levels by 2029. Under strategy (2) after a brief surge in per capita consumption rate, there is a swift decline, resulting in a population crash by 2019, which is even a few years earlier than under the mid- and late-stage mitigation strategies.

Either of these early-stage export mitigation strategies would cause NA and CH to have substantial, 40-60 percent, declines in per capita consumption as compared to 2011 levels. But, per capita consumption never drops below the 1 b/py critical level, and therefore, I do not predict a population collapse.

EU could stave off a population crash until 2029 under strategy (1) and only until 2018 under strategy (2). And, I would expect EU to have much worse economic collapse than for NA or CH, since the relative change in per capita consumption of 80-90 percent is predicted to be much greater than for these two regions.

That leaves us we the two biggest losers under an early-stage export mitigation strategy—JP and rAP.

For JP, having no significant domestic production or reserves, the economic and population crash is immediate.

Although rAP produces petroleum and has significant reserves, it is unlikely that its production could be increased to a rate that could keep the present population of 2.4 billion at the 1 b/py critical level. So just like JP, rAP would suffer an immediate population crash of about 1 billion people and then experience slower drop of another 1 billion people by 2038 until getting back down to it’s year 1900 population level.

-----------------------

This wraps up my exploration of export mitigation scenarios.

Next time, after answering some mail, I will be back with a wrap up of this series, where I plan to step back and take a more global view of the population implications the various scenarios explored in the series.