South America (SA) is the smallest of the four net petroleum exporters in my nine-region analysis, behind the Middle East (ME), the former Soviet Union (FS) and Africa (AF), and as you will see, an important importer to North America (NA), although that is changing in favor of increasing imports increasingly, to China (CH), the remaining Asia-Pacific region (rAP) and European region (EU). SA bears some similarity to AF in than its petroleum consumption rate trend is following an unsustainably rapid growth curve, and, so like AF the ELM analysis and PIE analysis provide contrasting predictions of consumption and net export rates.

Figure 17 presents the reported production, consumption and calculated net exports rates (dark blue, bright red and dark green open circles respectively) and the corresponding nonlinear least squares analysis (NLLS) best logistic equation best-fit curves (solid lines with the same respective colors ).

Production rates in SA follow two distinct trend periods, which I modeled using two separate logistic equation fits to 1965-78, 1979-2011, respectively. Similar to ME and AF, consumption rates in the SA are well-modeled using a single logistic equation fit to the entire 1965-2011 time span.

The best fit parameters of Qo, Q∞ and the rate constant "a" are summarized in Table 5 below:

Table 5 summary of best fit parameter for production and consumption for SA

| |||

Qo (bbs)

|

Q∞ (bbs)

|

a (yr-1)

| |

Production 1965-1978

|

16

|

48

|

0.14

|

Production 1979-2011

|

20

|

183

|

0.060

|

Consumption 1965-2011

|

23

|

380

|

0.033

|

The logistic equation best fit to the production rate data for the 1979-2011 time range suggests that production rates peaking in about 2013 at about 2.8 bby and declining thereafter. The logistic equation best fit to the consumption rate data for the 1965-2011 time range suggests that consumption rates continuing to climb until it peaks in 2048 at about 3.1 bby, that’s about 36 percent larger than SA’s consumption rate in 2011, from the data in the BP review. The consumption line (red line) crosses the production line (blue line) in 2022, and therefore according to the ELM analysis, in 2022 SA would become an ex-net exporter and either live within its own production means, or, transition into becoming a net importer in an attempt to meet its predicted future increasing consumption demands suggested by the red line.

The prediction of zero net exports in 2022 is four years later than the prediction of zero net-exports in 2018 made in my earlier analysis, Estimating the End-Part 3, about 1.5 years ago.

The present analysis which includes the 2010 and 2011 data from the BP review suggests that both production and consumption rates have increased at a faster rate than in the past, but, production has increases a little bit faster, and therefore, the time to hit zero-net exports, according to the ELM analysis, is extended by 4 years.

What does my PIE analysis do with the data for SA?

Predicting Petroleum Export Rates from SA to other Regions

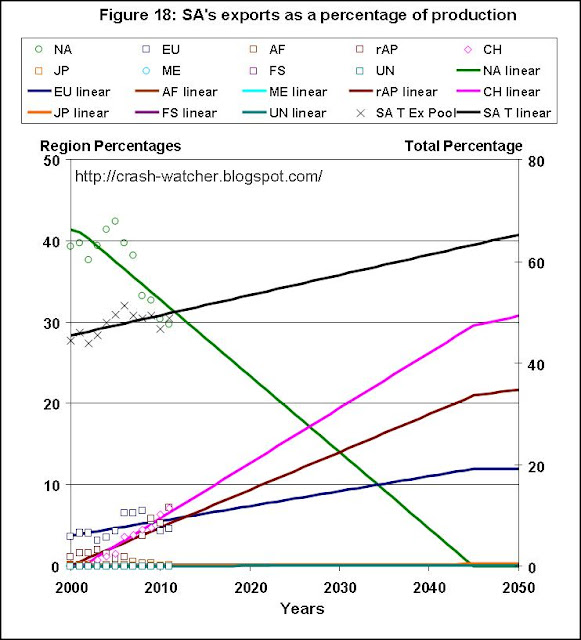

Figure 18 shows the relationship between petroleum production rates and export rates for the SA, as already worked out in my previous study from a few months ago. This is actual the same as Figure 2 in Part 1 of “Relationship between Petroleum Exports and Production.”

Figure 19 shows predicted absolute regional exports from SA to the other regions, based upon the combining the production rate trends shown in Figure 17 with the export trend lines shown in Figure 18.

Because SA’s production rate is predicted to peak soon, in 2013, but, the export rate trend is upwards (black line in Figure 18), SA’s total exports are predicted to peak a few years later in about 2017 (black line, Figure 19).

As you can see SA’s flat to slowly declining exports NA over the last decade are predicted to accelerate downwards over the next and future decades. This trend is due to the cooperation of the two trends shown in Figures 17 and 18: declining production rates after 2013 and continuing declining proportions of exports going to NA. In contrast, the export trends for EA, CH and rAP show continued increases until the mid 2020s to early 2030s, after which exports to these regions also declines. These trends are due to the conflict of two trends shown in Figures 17 and 18: declining production rates after 2013 but continuing increasing proportions of exports going to EU, CH and rAP.

Predicting Petroleum Import Rates to SA from other Regions

Over the past decade SA has received about the same amount of imports from other regions as AF has, although as you will see, the predicted future trajectory of those imports are quite different than for AF.

Figure 20 shows the sum (black line) and individual import contributions, from each of the other eight regions, to SA.

Over the last decade, total imports to SA have been about one-third the size of SA’s total exports. In 2000, exports from ME and AF were about as larger as imports from NA, and, imports from FS were also fairly large. But in the future, SA will be much more dependent on exports from NA. For instance, according to the trend lines shown in Figure 20, by 2020, also 70 percent of SA’s total imports of 0.65 bby are predicted to come from NA.

Imports from NA, and to much lesser extents from CH and rAP, are predicted to increase because of the exports trends and continued production from both of these regions (to be shown in futures installments of this series). However, absolute imports from ME and FS rapidly declined over the decade 2000-2011, due to declining proportions of exports coming for these regions (see e.g., lime green lines in Figures 3 and 8, in Part 2 and Part 3 of this series, respectively; these lines are barely visible in the lower left corners of the figures, because ME’s and FS’s exports to SA are quite small compared to several other regions).

This downturn in exports from ME and FS was partially mitigated by increased exports from AF to SA. But this is predicted to have peaked around 2009 and decline thereafter, due to the predicted declining production rates from AF as discussed in Part 4 of this series. SA does get some increasing rates of exports from EU, but, this is also predicted after 2011, due to the continued declining petroleum production rate from this region (to be shown in futures installments of this series).

Predicting Consumption Rates for SA based on the PIE analysis

I applied my normalization to SA in the same manner as done for AF. For SA, the average calculated consumption rate, based on the summation of production plus imports minus export for the 2001-2011 time range, was 0.123 ± 0.085 bby lower than the reported consumption rate reported in the BP review. Therefore my normalization for SA consisted of adding 0.123 bby from the predicted future consumption rate and adjusting total net exports downwards by this same amount. And, like AF, I did not attempt to distribute apply this correction proportionally among the individual absolute exports and absolute import to and from each of the other regions.

Figure 21 shows the production, consumption and net export data, and corresponding best fit curves, the later two now shown as dashed lines. Added is the predicted net export (light green solid line representing total absolute exports minus total absolute imports plus the -0.123 bby correction) and consumption (blood red solid line) prediction curves based on my PIE analysis (also with the +0.123 bby correction).

The results presented in Figure 21 suggest that if SA’s production rate follows the logistic equation best fit (solid blue line), and SA’s export and import rate trends continue along the lines shown in Figures 19 and 20, respectively, then the predicted total export rate curve (solid green line) is extended beyond 2022 into the 2030s before hitting zero in about 2037.

This is very analogous to the PIE results reported in Figure 16 for AF in Part 4 of this series. And like AF, SA predicted future consumption is very much curtailed as compared to the logistic equations extension of SA’s current consumption trend. Rather, petroleum consumption rates stay pretty flat over the next decade, as do net exports. Then in the mid-2020s as SA’s domestic production rates start going into serious decline, net positive exports steadily decline until hitting zero in 2037 at which point SA becomes a net importer. The decline in SA’s predicted consumption curve looks like a much softer landing than any of the net-exporting regions because the steadily increasing import rates from NA and CH buffer the decline. Nevertheless, there would still be economic fall-out associated with the lost revenues from declining exports and increasing cost to import petroleum.

Half-time Summary: a brief look at the four net exporting regions

Now that I have finished my survey of the four net exporting regions (ME, FS, AF and SA), I am about half-way through this series. So, let’s step back and look at the production, consumption and net export trends of these four region as a whole.

Figure 22 shows the best-fit trend lines for each of the four regions and the sum of all four regions—I have kept the same color codes for product, consumption and net predicted by the ELM and PIE analysis.

The lines shown in Figure 22 are simply the sums of the each of the individual lines for the four regions shown in Parts 2-4 of this series. Additionally, I only show the predicted net exports until they hit zero—as discussed in Parts 3 and 4, AF and SA have a history of receiving imports from other regions, as so it is possible the net exports for these four regions as a whole could turn negative. However, for the purposes of the present discuss I just want to focus on the time up to hitting net zero exports for these four regions as a whole, and the implication this may for these regions and the rest of the world.

The sum of the predicted petroleum production rates (blue line) shows a peak in 2009 at about 20.5 bby. That is equal to roughly two-thirds of the world’s total production rate of about 30 bby in 2009.

Figure 22 nicely illustrates the contrasts between the predicted consumption and net export rates resulting from the assumptions inherent in the ELM analysis versus the assumptions inherent in the PIE analysis.

Turning first to the ELM analysis, the sum of the assumed continued predicted consumption rate trends (bright red line) for the four regions suggests continuing increasing rates of consumption until peaking in about 2040 at about 10.7 bby, followed by a slow decline. This results in the sum of predicted net exports (dark green line) rapidly declining and hitting zero in about 2033. There is a widening discrepancy between the declining production rates and the still-increasing consumption rates after 2030. Indeed, by the time we reach the predicted peak in consumption rate, in 2040, the difference between predicted production minus predicted consumption equals about -5.5 bby. The difference gets wider by 2050 (-7.5 bby) and even wider by 2060 (-7.8 bby). I do wonder: where in the world these four regions would be able import such large quantities of petroleum from, and, what they would pay the imports with, since a large fraction of the income from these regions comes from the sale of petroleum exports.

Turning now to the PIE analysis, the assumed continued export and import rate trends for the four regions suggests declining net exports, but, net exports do not reach zero until after 2050. The resulting sum of predicted consumption rates suggests a peak in 2010 followed by gradual decline thereafter.

In my opinion, the scenario suggested by the PIE analysis seems much more tractable than the scenario suggested by the ELM analysis because the yearly changes in consumption rates and net-export rates are more moderate, or at least, the time for the occurrence of large year-to-year changes is substantially delayed.

Figure 23 further illustrates this point by presenting the year-by-year percentage changes in the production, consumption, and net exports rates following the production peak in 2009. Again, I am keeping the same color scheme for product, consumption and net predicted by the ELM and PIE analysis.

As you can see production rates declines at between 0 and -5 percent per year (%/y) from 2010 until about 202,5 at which point, the decline rate increase slightly to about -6.3 %/y.

In contrast, according to the ELM analysis, consumption rates stay positive, ranging from +2.3 %/y in 2010 to 1.2 %/y in 2025, and then gradually declining to 0 %/y until the peak in 2040. The consequence of this assumption is that the change in net export rates rapidly plummets, reaching -15 %/y by 2025, and, decreasing by even greater yearly relative amounts. This illustrates the rapid and immediate decline in export income that these four regions as a whole would suffer.

On the other hand, the PIE analysis predicts a more moderate decline in exports rates. By 2025 the decline rate has only reached -6.7 %/y. The export decline rate eventually hits -10 %/y—but not until 2034, and even then, the decline rate stays in the range of -10 to -11 %/y until 2042. Thereafter the decline rate accelerates until 2055—this is the point when net positive exports from the ME final hits zero. The decline rate of -12 %/y thereafter is just reflecting declining export rates of small amounts of petroleum from the sole remaining exporter of the four regions—FS. What consequence does the PIE analysis export scenario have for the consumption rate for these four regions as a whole? The PIE analysis predicts that after 2010 yearly consumption rates decline immediately, but the yearly change never exceeds -3 %/y for the next 40-50 years.

So there you have it: the ELM analysis’ assumption of continuing increasing consumption, which drives net exports to zero by the early 2030s in order to sustain continued increases consumption rate until 2040, but only if supplemented by serious amount of imports, versus the PIE analysis’ assumption of continuing the current export/import trend, which still results in declining rates of net exports but at a slower rate, and, at the cost of immediately decreasing domestic consumption rates.

Which do you think is more likely?

As I already mentioned, I favor the PIE analysis because of its prediction of more moderate decline rates in net-exports, which is an important income source for these regions. However, this is at the cost of declining consumption rates. Although the decline is consumption rates of less than -3 %/y for these for regions, as a whole, looks tractable, this may not be the case for some of the individual regions, in particular FS and AF. As I discussed in part 3, the PIE analysis’ assumption of continuing the present export/import rate trend, drives FS consumption rate to zero in 2028. Making the same assumptions for AF nearly drives, AF’s consumption rate to zero by the early 2030; the only reason it doesn’t go to zero is because of the trend lines predicting continuing imports from NA and CH.

Just what would this intervention scenario entail, when would it start and how long could it forestall consumption rate dropping below some critical level?

I have some very definite ideas about the answers to these questions—in fact I have already run the scenarios. But first, I need to finish this nine-region survey!

One final note, regardless of whether one accepts as most likely, the scenario suggested by the ELM analysis, or, the scenario suggested by the PIE analysis, net exports from these four net exporting regions is on a serious down-hill slope.

For instance, consider the length of time to reach 50% of the predicted peaking net exports of about 13 bby from these four regions in 2007-2008. According to the ELM analysis, net exports drop by 50% to 6.5 bby in about 2019-2020, and according to the PIE analysis, about 5 years later in 2025.

Of course, this would have dramatic worldwide effects, but, the net-importing regions most affected would be those that are most dependent upon getting their imports from one or more of these four net-exporting regions. Europe and Asia , I am talking to you.

-----------------------

Next time, I will turn my attention to North America , a region that is presently a large net petroleum importer, but, which could become a net exporter in less than 20 years from now—although probably not in the way that you may think.

Post #100--yeah!

No comments:

Post a Comment

Your comments, questions and suggestions are welcome! However, comments with cursing or ad hominem attacks will be removed.