The United States of America cannot afford to bet our long-term prosperity and security on a resource that will eventually run out. Not anymore. Not when the cost to our economy, our country, and our planet is so high. Not when your generation needs us to get this right.

It is time to do what we can to secure our energy future.

So today, I'm setting a new goal: one that is reasonable, achievable, and necessary. When I was elected to this office, America imported 11 million barrels of oil a day. By a little more than a decade from now, we will have cut that by one-third.

I set this goal knowing that imported oil will remain an important part of our energy portfolio for quite some time. And when it comes to the oil we import from other nations, we can partner with neighbors like Canada, Mexico, and Brazil, which recently discovered significant new oil reserves, and with whom we can share American technology and know-how.

I think that it is every politician’s dream to know what will likely happen in the future, then set this as their goal, and when it happens, claim a great victory. If the trend for declining exports continues, President Obama may get his wish of cutting exports by one-third without having to do anything at all.

Here in part four, I put together the results of my seven-region global analysis summarized in part 2 and part 3 of this series, and predict the future trends for global net exports.

Global petroleum export trends

It is apparent from parts 2 and 3 that at present, of the seven regions considered, only four are net exporters: the Middle East (ME), Africa (AF), former Soviet Union (FS) and South America (SA). The other three regions, Asia-Pacifc (AP), Europe (EU) and North America (NA), are all heavy petroleum importers and have been importers throughout 1965-2009.

It follows therefore that the sum of regional net exports from ME, AF, FS and SA corresponds to global petroleum exports.

Figure 8 shows the sum of reported regional net exports for ME, AF, FS and SA (open green circles), and, the sum of the predicted net exports based on my best fit NLLS analysis of these for regions, as described in parts 2 and 3 (solid and dashed curves).

The predicted net export curves track the reported net exports fairly well throughout the 1965-2009 time range of the BP data set. Based on the prediction curve, there were two peaks in global net exports: 11 bbs/yr in 1976 and 13 bbs/yr in 2007. The peak value in total exports in 2007 is slightly less than the sum of net exports from all current (2009) exporters of 16,4 bbs/yr as estimated by George Lordos in Net Oil Exports Will Drop To Zero Long Before Oil Production Does (Table 1 of Lordos’s article indicates that the sum of net exports in 2009 equaled 44895 kbd or 16.4 bbs/yr). I suspect that this 3.4 bbs/yr difference reflects the intra-regional exports that Lordos's analysis should include, while my present analysis only considers inter-regional exports, that is, net exports out of the ME, AF, FS and SA regions.

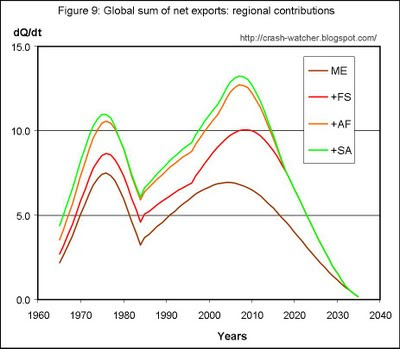

Figure 9 shows the predicted export curves (specifically, the "no sharing" scenario shown in Figure 8, as further discussed below) with the relative contributions from the four exporting regions. I think that this figure nicely shows the dominant roles of the ME and FS as the number one and two export sources in the world today, and, going forward. As I pointed out previously, Saudis Arabia and Russia

ME in 2010 is predicted to account for 51% (6.5 bbs/yr) of the 12.7 total regional net export pool, with FS in second place at 28% (3.5 bbs/yr), AF third at 18% (2.2 bbs/yr) and SA at only 3% (0.44 bbs/yr).

Figure 9 also nicely illustrates that AF and SA are both predicted to hit zero net exports in about 2018—only seven years from now. So, by 2019, global exports are really down to ME and FS.

Sharing and no sharing scenarios for the ex-exporters AF and SA after 2018

The dashed line in Figure 8 shows the sum of reported exports for a scenario where, once a region becomes an ex-exporter, it just "goes away," and lives within its means, without attempting to import any oil from the remaining pool of global exports. That is, the remaining exporting regions do not share their exportable oil with the ex-exporting regions. For example, when AF and SA both hit zero-net regional exports in about 2018, the dashed line shows the remaining exports from ME and FS, assuming that AF and SA do not important any petroleum from ME and FS. Effectively, this means all the remaining exports continue to go to AP, EU and NA, until FS reaches zero net exports in 2033 and then ME reaches zero net exports in 2035.

The solid line in Figure 8 shows the opposite scenario where, once a region becomes an ex-exporter, it is able import all of its needed oil from the remaining pool of global exports. That is, the remaining exporters fungibly share their oil with these ex-exporters first before sharing with AP, EU and NA. For example, when AF and SA both hit zero-net regional exports in about 2018, they are able to make up all of their predicted petroleum short fall (based on the best fit of the Hubbert equation to the consumption rate data) from ME and FS first, and then the remaining export pool of oil goes to AP, EU and NA. According to this scenario zero net exports is reached globally in 2030.

Of course, I am not expecting either of these scenarios to actually occur. Rather, something in-between is what I expect to happen. The complete "sharing" scenario accelerates the time when global net exports end to 2030. The "no sharing" scenario slightly delays the time when global net exports end to 2035. Considering these two extreme scenarios therefore allows me to set the lower and upper time boundaries where global net exports are predicted to end—sometime between 2030 and 2035.

Despite the fact that I am combining the predicted export curves for four different regions (ME, FS, AF and SA) I find it remarkable how linear the declining sum of export curves looks through the 2010s and 2020s. This also looks like a remarkably steep slope that I would not want to ski or even slide down on with a hard floor at the bottom, but I'm afraid that we won't have much choice in the matter.

For instance, for either the "sharing" or "no sharing" scenarios, taking 2007 as the year of peak exports (100%), exports are predict to have declined by about 50% by about 2020. That's an average annual decline rate of about -3.8 %. For the "sharing" scenario the decline rate continues on at an even steeper pace hitting zero exports 10 years later in 2030—a -5%/yr decrease. For the "no sharing” scenario, the decline rate is still steep enough to reach zero net exports 15 years later in 2035—a -3.3%/yr decrease

So, what about the prospects of President Obama reaching his “goal” of cutting foreign imports by 1/3 in a decade (although Canadian and Mexican oil are still okay it seems)?

Well, North American (basically USA

What a victory!

Only this victory is akin to saying that you have achieved a target of losing 50 pounds—by cutting off your right leg. What would the economy of the USA

What about Consumption?

Based on these export trends, I can also make an informed speculation about the future consumption trends for these seven regions.

Next time, I will discuss what the end of global exports could mean for the future consumption trends the seven different regions.

Perhaps you will be surprised by which regions appear to be in the greatest jeopardy of having a total collapse in petroleum consumption. Or, as the politicians will say, achieving the goal of energy independence!

No comments:

Post a Comment

Your comments, questions and suggestions are welcome! However, comments with cursing or ad hominem attacks will be removed.