In this post, I finish my exploration of the relationship between petroleum exports and production for the remaining six of my nine-region analysis.

Last post, I mentioned that JP actually exports more production than its own domestic petroleum production. Consequently the plots in Figure 4, showing exports as a percent of production have a vertical scale that well exceeds 100 percent.

Even than EU, JP’s exports are petroleum products. For instance, according to the BP reviews for the corresponding year, in 2000, JP exported 79 tbd of petroleum products and 2 tbd of crude oil—about a 40:1 ratio. In 2011, JP exported 290 tbd of petroleum products and 1 tbd of crude oil—nearly a 300:1 ratio! In contrast, the ratio of crude oil to petroleum product imports for these two years were both about 4:1. So, it seems that JP can make some money by importing crude, producing products from that imported crude and its own meager production and export some of the products.

Using the relationships shown in Figure 4 to predict JP’s future exports might seem more tenuous than for other regions, given that JP imports so much more than it produces domestically. Still, I think that Japan

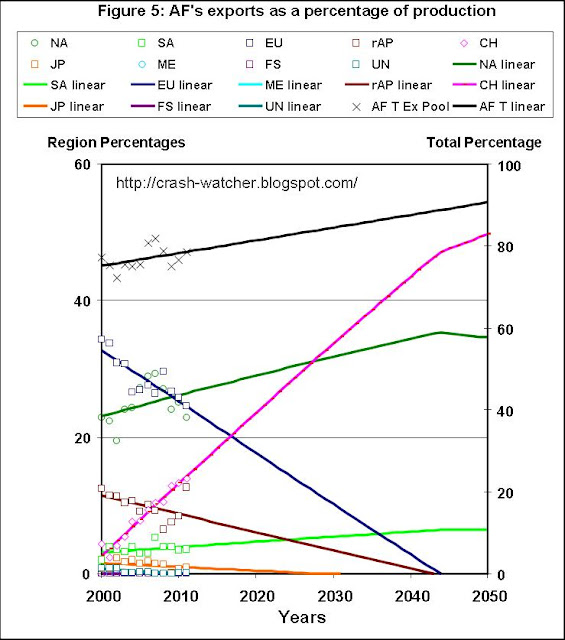

Overall, the trend (black line and Xs) is for AF’s exports as a percentage of it’s production is slightly increasing (r2 = 0.17), and this is a reflection of negative and positive trends. There are declining exports to EU, rAP and JP and increasing exports to NA, SA and CH.

Unlike all eight of the other regions, ME’s overall exports (black line and Xs) as a percentage of it’s production is strongly declining, at about -0.92 percent per year (r2 = 0.86), although not all regions are experiencing declining exports from ME. ME’s exports to its traditional destinations: NA (r2 = 0.87), SA (r2 = 0.74), EU (r2 = 0.95) and JP (r2 = 0.91) are all decreasing, and exports to AF are also decreasing, with a slight up-spike in 2011, again probably to compensate for decreased production in Libya

The proportionally small amount of exports to SA is predicted to end around 2013. If the downward trends in exports to EU, NA and AF all continue, then we will see exports from ME to these regions all hitting zero in the mid-2020s: 2023, 2027 and 2028, respectively. Exports to JP from ME would be much later in about 2041. Once again, the different regions hitting these zero points explains the discontinuity in the upward trends in CH and rAP as I normalize these data so that they continue to equal the region’s overall downwards trend line (i.e., the solid black line).

Former Soviet Union (FS) : relationship between petroleum production and exports

FS’s total exports as a percentage of it’s production are slightly increasing at +1.2 percent per year (r2=0.80). With three exceptions, FS’s exports are increasing to all the regions. The first exception is the declining rate of already small exports from FS to SA (r2 = 0.77). The second exception is not really a region; it is UN—the mysterious unidentified destinations of FS’s petroleum exports, first mentioned above in the context of Figure 3 for EU. The third exception is AF which has been receiving small flat rates of exports from FS.

By far, the largest destination for FS’s exports is EU. EU receives about 40-50 percent of FS’s production—with an increasing trend of +0.48 per year (r2 = 0.21). FS’s exports to EU helps to mitigate the above-mentioned declining exports from AF and ME to EU. There are similar sized, but more significant, trends of increasing imports to both NA and CH at both at +0.45 per year (r2 equal to 0.84 and 0.86, respectively). In fact, the increasing export trends from FS to NA and CH are virtually identical, which is why I presented the export trend lines to these two regions as dashed lines. There are also increasing exports to JP and rAP, although these are increase at about one-third of the increasing rates of exports to EU, NA and CH.

Despite the trends for several other regions to have increasing exports to this regions, there is still an overall positive trend for CH’s exports as a percentage of production to increase (+0.56 percent per year, r2 = 0.44). Somewhat similar to AF, the overall trend reflects a combination of decreasing exports to some regions and increasing exports to other regions. For instance, exports to NA and JP are declining, and, are both on trend lines to reach zero in about 2011-2012 (r2 equal to 0.68 and 0.83, respectively). The largest export destination is rAP which in 2011 received exports from CH corresponding to about 11 percent of its production. But there is also a strong trend for increasing exports from CH to SA (r2 = 0.86). Remarkably, is the smaller trend for increasing exports to EU.

CH’s increasing exports to other regions appears to be similar to EU’s and JP’s export trends—the exports are predominantly petroleum products. For instance, according to the BP review, in 2011, CH exported 623 tbd of petroleum products, but only 30 tbd of crude oil—that’s a product:crude export ratio of about 21:1, which is three times larger than the 7:1 ratio for EU.

The remaining Asia-Pacific region (rAP): relationship between petroleum production and exports

Overall the trend (black line and Xs) is for rAP’s exports as a percentage of production to increase (r2 = 0.52) reflecting a combination of opposite regional export trends. Exports to JP (orange line and symbols) and to NA (dark green line and symbols) are in decline. If the trend continued exports to JP will end around 2027—this explains the discontinuity in the upward trends in CH, EU, SA and rAP. The largest destination of rAP’s exports is CH, replacing JP in the mid-2000s. Again, like CH, there is a trend for increasing exports to EU (r2 = 0.90), at about +0.5 percent per year. Like FS and CH then, rAP is helping to mitigate the declining exports from AF and ME to EU. And similar to CH, most of rAP’s exports are product exports. For instance, according to the BP review, in 2011, rAP exported 4589 tbd of petroleum products, and 990 tbd of crude oil—that’s a product:crude export ratio of about 4.6:1.

Some final thoughts

Well, I have been barking on and on about the inter-regional trade movements of petroleum for about the last dozen-and-a-half posts, over the past half year, and, I can hardly believe that my analysis is complete! I think that some very interesting trade movement dynamics have been uncovered, and as best I can tell, no one in the blogosphere, or even in academia, have the slightest clue about them. Maybe some folks within BP have a clue, but, they aren’t talking.

For instance, I wonder how many people have a clue about how Europe, North America, Japan, China and the remaining Asia-Pacific region’s export sources have been changing over the past decade, and what implications this will have for petroleum consumption trends in these regions going forwards.

I am now closer to the point where I can use the relationships shown Figures 1-9 to predict exports from all of the nine regions to each of the other regions—but first, I need to update my analysis of domestic production for each region.

No comments:

Post a Comment

Your comments, questions and suggestions are welcome! However, comments with cursing or ad hominem attacks will be removed.