Mexico has recently been another top petroleum provider to the USA Mexico,

Recently though, Mexico

The declines are in no small measure due to steep declines in Mexico

According to the EIA country analysis brief for Mexico , the USA receives the “vast majority” of Mexico ’s crude oil exports, mostly via tankers at the Gulf Coast Mexico

Non-linear least squares (NLLS) analysis of total petroleum production

Figure 1 shows total petroleum production for 1965-2009 as reported in the BP statistical review. The solid red line is the NLLS best fit to the full data set using the Hubbert equation with the parameters “a,” Qo and Q∞ allowed to vary to minimize the sum of the residual sums of squares (Srss). The best fit (“a” = 0.09447; Qo = 2.02; Q∞ = 57.08) looks like it is skewed by the local peak which occurred in 1992. Nevertheless, the down trend in production is quite clear, especially for the time span from 1999-2009, which is probably reflecting the peak in production (in about 2004-2005) and subsequent decline in the Cantarell field.

Figure 1 also shows two other NLLS best fits to partial data sets using the Hubbert equation. The pink line shows the best fit to the 1965-1986 time span (“a” = 0.2575; Qo = 0.09; Q∞ = 16.89). The orange line shows the best fit to the 1999-2009 time span (“a” = 0.1773; Qo = 9.15; Q∞ = 31.21). It is that later time span extrapolated to the future, which probably lead the EIA to predict that Mexico

Modified analysis of the production data from 1980-2009

Similar to that done for the USA and Canada analysis in previous posts, I used the best fit values of “a”, Qo and Q∞ obtained from fitting the 1965-86 data using Hubbert’s equation, shown in Figure 1, as “fixed” parameters for a subsequent fit to the 1987-2009 data, using equation [9], derived in Part 7 of the “Refining the Peak Oil Rosy Scenario” series, with “a”, Qo and Q∞ fixed to their best fit values from the 1965-1986 analysis and one or both fca and fcq varied. The results are shown in Figure 2 below:

The solid blue line in Figure 2 shows the best fit to the 1965-1986 data using the Hubbert equation (once again, (“a” = 0.2575; Qo = 0.09; Q∞ = 16.89). The solid green line shows the best fit obtained to the 1987-2009 data using equation [9] with fca = 0.0928 and fcq = 1.09.

The overall Srss obtained using the Hubbert equation to the full data set (1965-2009) equaled 0.7925. The sum of the Srss for the Hubbert equation fit to 1965-86 (Srss = 0.1056) plus the modified equation [9] best fit to 1987-2009 (Srss = 0.5636) with only fcq varied (best fit fcq=1.042) was significant less (F-test, p<0.01).

However, the sum of the Srss for the Hubbert equation fit to 1965-86 (Srss = 0.1056) plus the modified equation [9] best fit to 1987-2009 (Srss = 0.0726) with both fcq and fca varied gave a still better fit than the fit with only fcq varied (F-test, p<0.0001).

These best fit parameters from fca and fcq imply that for the 1987-2009 time span there is a trend for the total extractable oil (Q∞) to increase 9 percent per year while the rate constant for production (“a”) is decreasing by 7.2 percent per year. The increase in Q∞ does not overcome the decrease in “a” and therefore there is an overall trend for a decrease in the production rate (dQ/dt) through the 1987-2009 time span. This trend is interrupted by the spike in production centered at 2004, however.

The trend based on the modified equation [9] analysis of the 1987-2009 data predicts the production rate decreasing from a peak in 2003, which is about the same as the actual peak in 2004. It also predicts the projected decline curve being shallower than that predicted from the Hubbert equation best fit of the full 1965-2009 time span or to the actual 1999-2009 data. The modified fit using equation [9] does not do too good a job of modeling those most recent years of production data, which first over shoots and then undershoots the equation [9] prediction curve.

Therefore in my subsequent analysis, I have focused more on the results of the Hubbert fit to the 1999-2009 time span as this may be a better predictor of the near-term future production trends for Mexico

Non-linear least squares (NLLS) analysis of total petroleum consumption

Figure 3 shows the best fit to Mexican petroleum consumption data (as reported in the BP statistical review):

Figure 3 shows the best fit to Mexican petroleum consumption data (as reported in the BP statistical review):

The red line in Figure 3 shows the best-fit of the Hubbert equation to the full data set 1965-2009 from the BP statistical review (“a” = 0.0755; Qo =1.74; Q∞ = 37.89).

The fit to the full time span of data looks much better than the comparable full data fits to USA or Canadian consumption data, most likely because the spikes in consumption around 1980 and 1990 are very mild or non-existent in Mexico

The best fit to the consumption data suggests that the rate of consumption peaked in 2005, close to the same year as production peaked, and is now declining.

I find it interesting that the consumption rate constant (“a”) for Mexico USA ’s (4.0% /yr for the 1984-2009 time span) and Canada Mexico Mexico ’s production was 30% of Canada ’s and less than 3% of USA ’s production, whereas at its peak in 2004, Mexico ’s production rate was about 60% of Canada ’s and 30% of the USA USA and Canada Mexico

Comparing future trends in Mexican petroleum production and consumption

Comparing future trends in Mexican petroleum production and consumption

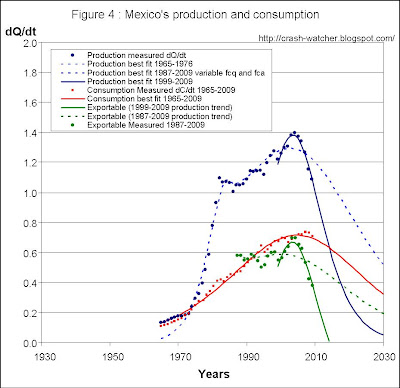

Figure 4 shows the best fits obtained using the Hubbert equation analysis of the total time span of Mexican consumption data and the 1999-2009 production data, and, my modified analysis of the 1987-2009 production data (dash line) using equation [9].

The predicted export curve is shown based on both the prediction based on 1999-2009 production data trend (solid green) and based on the prediction based on the 1987-2009 production data trend (dash green). Additionally, I show the actual “measured” export data from 1987-2009 (i.e., the BP statistical review reported production minus reported consumption).

The extrapolated export trend predicts that if the Mexican production trend from 1999-2009 continues, then Mexico

On the other hand, if the Mexican production trend from 1987-2009 proves to be a more accurate predictor then, the decline in exports is predicted to be much more gradual still providing net exports but diminishing exports to 2030 and beyond. Even if the predicted trend based on the 1987-2009 production data turns out to be more accurate in the long run, Mexico

My expectation is that in the long run, exports will be somewhere in-between what is predicted from the 1999-2009 production trend and what is predicted by the 1987-2009 production trend. That is the production trend will reverts back towards the longer 1987-2009 trend, e.g., because the rate of decline in Cantarell will become less steep, or, there is increasing production in the KMZ or other offshore fields, or both.

BUT, even if the steep decline predicted from the 1999-2009 data analysis continues only out to 2015 and then reverted to a shallower decline trend predicted from the 1987-2009 data analysis, it won’t matter because the amount of petroleum produced at that point would already be below the domestic consumption rate, and therefore, provide no net petroleum exports.

Only time will tell which of these trends prevails, but what seems undeniable to me is that the years when Mexico could export plus 0.5 bbs/yr (or about 1.3 mb/d), mostly to the USA

--Updated Nov 28, 2010: as explained in Canada—Petroleum Superpower or Super-slave? --

Impact on

Figure 5 reproduces the USA Mexico (green circles) and similar measured exportable petroleum data for Canada

The solid green line then depicts the sum of predicted USA production and exports from Canada and Mexico USA from Mexico will be a pittance of what Mexico used to export to the USA , or, what the USA

For 2010, I predict that Canadian and Mexican exports together with USA ’s domestic production will provide about 48 percent of the USA USA ’s production plus Canadian exports is predicted to provide 42 percent of the USA ’s consumption needs, with nothing from Mexico

In the coming years following 2015 I predict that Mexico will provide little to nothing to meet the USA

Implications for

Although this article is mainly focused on the petroleum import implications for the USA, I think it is worthwhile to briefly consider what impact the cessation of being an oil exporting county, from 2015 on, will have on Mexico. Because Mexico is the USA next-door neighbor, what happens in Mexico will affect the USA

Perhaps becoming a net importer will not be too much of a shock for the people of Mexico

But going forward past 2015, what will pay for those refined petroleum products? Certainly not money earned from the net export of petroleum, as there will likely be little to no net exports. If some of the petroleum produced has to be sold for the import of refined products, then this will cut into the amount of petroleum available for domestic consumption.

As I noted above, the EIA estimated that 40 percent of total government revenues rely on earnings from the oil industry. If there are no net exports, then I expect that this will strongly negatively impact government income. The Mexican government’s ability to provide basic service and maintain the country’s infrastructure will accordingly severely tested. Should there be a further breakdown in these services and infrastructure in Mexico , this will surely have a negative impact on the USA

Dear Crash_Watcher, thanks for all your analyses of many of the details of petroleum production, supply, and demand, in this and other posts. There is much to learn from your modeling efforts.

ReplyDeleteAn additional area of interest, which has been addressed tangentially but I don't believe directly in your modeling, is how disruptions in supply would affect price of petroleum and its products. Disruptions in supply would certainly send prices higher, perhaps much higher, which would affect individuals differently, depending on their income level and priorities. Governments may indeed enact rationing schemes, though I suspect this would be on top price changes which would essentially change the accessibility of gas/diesel to the less-affluent. Perhaps you could address the effect of price changes in your future modeling efforts, as well as add to your comments about "how to prepare". For example, your posts might encourage people to think through how they might adjust their lifestyle to a 2-gallon per day ration, but they may not have considered that it could be 2-gallons per day at $10 per gallon. Just an idea.

I have been looking for information on the possible outcomes for Mexico, as a country and for its people, of the arrival the time when Mexican consumption is greater than Mexican production. So it was very helpful to find your posts, even though this was not the main focus of any of them. I had seen other projections that this point could arrive as early as 2012, though they were far less detailed than your analysis which suggests 2015.

If you are aware of any resources (analyses, websites, or individuals) that might have useful information on the economic, political, and societal effects for Mexico of the change in status to an ex-exporter, in either English or Spanish, I would greatly appreciate it if you could direct me to them in a reply to this comment. Thanks again for all your efforts, and any suggestions you have for my investigations into the possible consequences for Mexico.

Hi Anonymous, thanks for your comments.

ReplyDeletePredicting oil prices, I think, is quite difficult as this will depend on many factors (speculators, government intervention, general market sentiment etc...) besides general production and consumption trends. Of course, I believe that the general trend is for prices to go up, but I expect very high price volatility. Too rapid a price increase, such as in the summer of 2008, will cause demand destruction, followed by price declines, and so the price cycle can continue.

I believe that at some point, during a high price spike, governments will intervene and put rationing into effect. And yes you make a good point—$10/G gasoline or even $20/G would certainly be possible, especially for those who are not very high in the rationing priority list. People who can afford to will pay the price, and those who cannot use the gasoline themselves will sell their ration into the black market.

I am not aware of any specific studies that have attempted to quantify the economic impact of a transition from export to ex-exporter for Mexico. It is an important question for many countries that are headed in that direction.

I believe that this transition will be quite harsh for a country, like Mexico, whose foreign income has been heavily dependent on oil exports. It is hard for me to imagine that Mexico’s consumption rate will continue at its current pace once it hits zero net exports. I decline in consumption in turn probably signals a decline in GDP. Perhaps like Tunisia (who hit zero net exports in the early 2000s), demand destruction in domestic consumption will be sufficient that Mexico will remain (or return to being) a slightly positive net exporter.